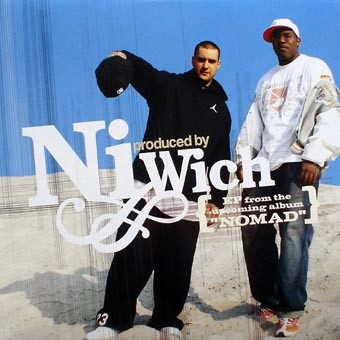

NI produced by Wich-EP from Nomad

01.My life + Tina

02.In this..

03.Sometimes

04.Revolution

05.Ladies and gentlemen

06.Live! + Indy

Download

Heslo: www.hip-hop.warezator.com

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamatut, 3. 2. 2024 17:08)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamatut, 3. 2. 2024 13:41)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamatut, 3. 2. 2024 8:45)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamatut, 3. 2. 2024 8:41)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamatut, 3. 2. 2024 5:42)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamatut, 2. 2. 2024 23:50)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamatut, 2. 2. 2024 20:47)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamatut, 2. 2. 2024 20:45)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamatut, 2. 2. 2024 13:37)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamatut, 2. 2. 2024 13:34)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

(Lamatut, 2. 2. 2024 8:23)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamatut, 2. 2. 2024 8:19)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

(Lamatut, 2. 2. 2024 2:21)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

(Lamatut, 1. 2. 2024 23:54)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

Toyhub247.com: Toronto's Trusted Destination for Quality Toys at Great Prices

(ToyHub247, 1. 2. 2024 16:13)

In the heart of Ontario, Canada, Toyhub247.com has emerged as a beacon for families and toy lovers in Toronto, offering an unparalleled online shopping experience. This trusted toy shop has quickly become renowned for its extensive selection of high-quality toys, competitive pricing, and commitment to fast, reliable shipping. Let's explore what makes Toyhub247.com stand out in the bustling market of Toronto's toy industry.

Quality Toys for Every Age and Interest

Toyhub247.com prides itself on a diverse range of products that cater to children of all ages and interests. From educational toys that nurture young minds to action figures and dolls that spark imaginative play, the store's inventory is thoughtfully curated to ensure that every item meets high standards of quality and safety. Toyhub247.com understands the importance of play in child development and strives to offer toys that are not only fun but also contribute to learning and growth.

Competitive Pricing Without Compromising on Quality

In a city as dynamic as Toronto, families are always looking for value, and Toyhub247.com delivers just that. The store's philosophy revolves around offering great prices without compromising the quality of its toys. This commitment to affordability is evident in their regular promotions, seasonal discounts, and special offers, making premium toys accessible to a broader audience. Toyhub247.com's pricing strategy ensures that every child in Toronto has the opportunity to enjoy high-quality playtime experiences.

Fast Shipping Across Toronto and Beyond

What truly sets Toyhub247.com apart from its competitors is its dedication to fast and efficient shipping. Understanding the anticipation and excitement that comes with ordering new toys, the store has streamlined its logistics to ensure that orders are processed and shipped out as quickly as possible. Whether you're in the bustling downtown core or the serene suburbs of Toronto, Toyhub247.com guarantees timely delivery, making it a reliable choice for last-minute gifts and spontaneous surprises.

A Seamless Online Shopping Experience

Shopping for toys online should be fun and easy, and Toyhub247.com has mastered this art. The store's website is designed with user experience in mind, featuring a clean layout, intuitive navigation, and detailed product descriptions complete with high-resolution images. This hassle-free online environment is complemented by secure payment options and a transparent order tracking system, ensuring a stress-free shopping experience from browsing to unboxing.

Building a Community of Trust

Above all, Toyhub247.com values the trust of its customers. The store has built a solid reputation in Toronto's community through consistent, reliable service, and a customer-first approach. Shoppers are encouraged to leave reviews and share their experiences, fostering a sense of community and trustworthiness. The store's responsive customer service team is always on hand to assist with inquiries, resolve issues, and provide personalized recommendations, further enhancing the shopping experience.

Conclusion

Toyhub247.com is not just a toy store; it's a trusted partner for families in Toronto and across Ontario, dedicated to enriching children's lives through play. With its commitment to quality, affordability, and speedy delivery, Toyhub247.com stands out as a top choice for toys in Toronto. Whether you're looking for the perfect birthday gift, a special holiday surprise, or just a new addition to your toy collection, Toyhub247.com offers a convenient, reliable, and enjoyable shopping experience that keeps customers coming back.

UNCENSORED!

(viopeesox, 1. 2. 2024 12:26)

Escape the ordinary with our Telegram channel. Immerse yourself in exclusive videos capturing intense tank turmoil, helicopter displays, infantry precision, and kamikaze drones. Join us for an uncensored glimpse into the untold realities that shape our world.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

Videos that shocked the internet!

(viopeesox, 1. 2. 2024 8:55)

Ready for an adrenaline-charged adventure? Our Telegram channel unveils unfiltered videos – tanks in turmoil, helicopters performing stunts, infantry strategizing, and kamikaze drones reshaping battlefields. Join us for an unvarnished exploration into the unseen side of warfare.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

UNCENSORED!

(viopeesox, 31. 1. 2024 20:15)

Greetings, truth enthusiasts! Break free from the mainstream narrative and join our Telegram channel for uncensored, firsthand videos. Experience the unfiltered reality that shapes our world. Get ready for an unvarnished perspective!

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

Guest Post permanent on DA 70

(Williamelics, 31. 1. 2024 19:39)

Guest Post permanent on DA 70

https://www.jackpotbetonline.com/

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57

SEARCHING FOR LOST BITCOIN WALLETS

(Lamatut, 3. 2. 2024 20:25)